A Proven Model for

AI-Run Companies

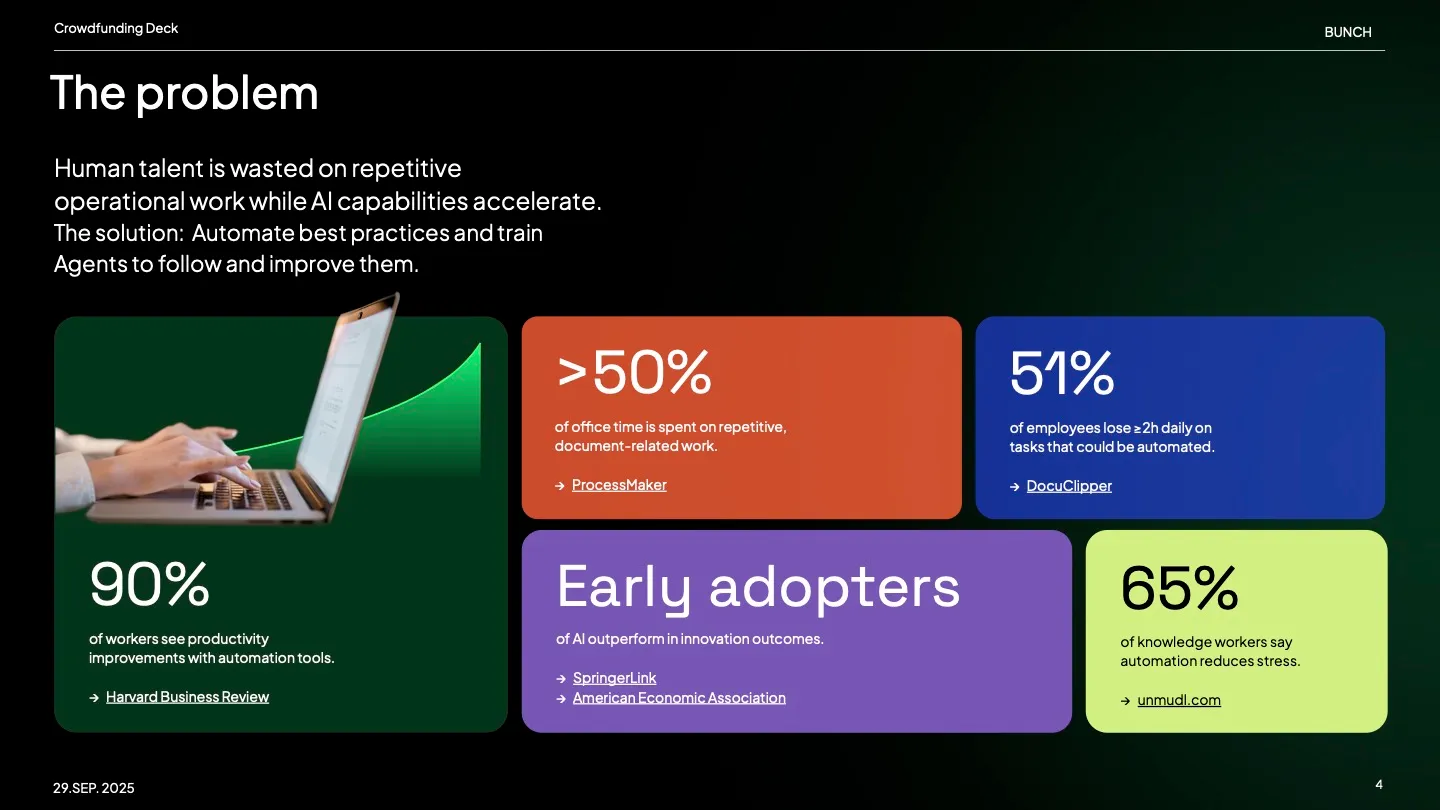

Companies spend 60-70%1 of their budget on human operations. We’ve built the solution: a system of AI agents that can run all core business operations. We started by proving the model works with a live, revenue-generating company. Now, we’re ready to license this platform to businesses across industries. This is your chance to invest in how companies will be run in the future.

We Build Companies Without Building Payroll

Hiring is one of the hardest parts of building a company. Founders spend most of their time recruiting, onboarding, managing, and re-hiring for the same roles. Plus, it can eat up 70%2 of a company’s budget. Bunch’s AI agents go to work without hiring, training, turnover, or massive cost.

Why Invest in Bunch

First-Mover Advantage

The first phase of the AI boom was about building the brains (chips and models). The next phase is about putting them to work. Bunch is the first opportunity to invest in a business model that runs itself with AI executing operations end-to-end.

70%+ Profit Margins

Companies spend 60-70%1 of their budget on human operations. By automating core functions like finance, marketing, and support, our model targets 70%+ margins.

Proven Traction

We’ve proven our model works by building a live business. It now has 65,000+ users, 24% month-over-month growth, and paying users from companies like Google, Meta, and Amazon.

Scalability

We aim to license our “company in a box” templates to help launch and operate automated companies across diverse industries.

We’ve proven the model works. Now we’re inviting investors to help us scale it.

3 Ways Early Investors Could Benefit

A Profitable, AI-Run Business

Bunch already operates a live, revenue-generating business powered by AI agents. As this business grows and becomes more efficient, it may generate surplus cash that can be reinvested into the company or, in the future, potentially returned to shareholders.

Acquisition

As Bunch scales its AI-run operations platform and expands into new markets, it could become an attractive acquisition target.

Public Listing

If Bunch continues to grow and reaches sufficient scale, a future public listing could provide liquidity by allowing shares to be bought and sold on a public market.

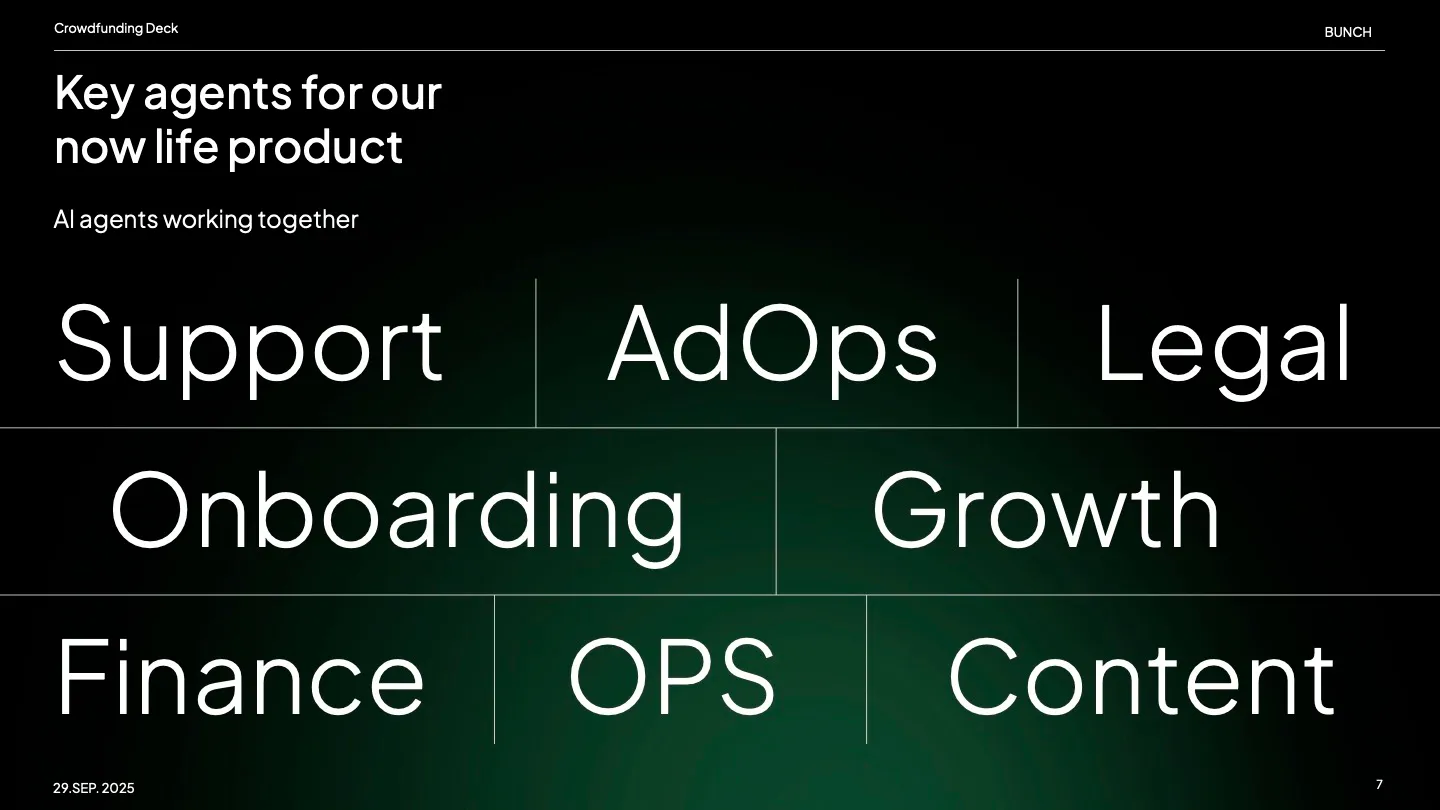

We Automate Business Operations

Our model lets companies scale revenue without scaling payroll. Most AI tools assist employees, and automation still requires human operators. Bunch is different. Our AI agents execute autonomously, coordinating, prioritizing, and acting.

The COO Agent:

Coordinates interactions between all other agents to ensure smooth operations.

The Finance Agent:

Handles bookkeeping, compliance, and filings autonomously.

The Growth Agent:

Runs campaigns, optimizes SEO, and manages content distribution.

The Product Agent:

Manages release cycles and feature building.

Powered by AI. Guided by Humans.

We believe in AI as an operator, not a replacement for vision. In the Bunch model, there are no traditional employees. Instead, human founders focus on what they enjoy doing.

Vision & Governance

Setting direction, values, and constraints

Oversight

Ensuring compliance and alignment

Creativity & Relationship

Partnerships, storytelling, and brand

Get the investor deck

We’ve Proven Our Model Works in the Real World

We applied our AI-native model to the $90B leadership development market. We chose leadership coaching because it’s a competitive market that requires constant engagement, making it an ideal environment to prove that AI agents can run a real business end-to-end. The results speak for themselves:

65,000+

Registrations since launch.

+24%

Month-over-Month Growth.

$525

Customer Lifetime Value (LTV).

$4.30

Cost Per Acquisition (Proof of AI marketing efficiency)

Used by managers at

How We're Scaling Our Model

We’re building a category-defining infrastructure, not just another app.

Month 3

Bunch retention validated, 80% of tasks completed by Al Agents

Month 12

>200,000 users,95% of tasks completed by AlAgents

Month 26

Returning capital to investors with autonomous business.

Unlock Up to 18% Bonus Stock

As a way of saying thanks for your early belief and support, we’ve created a tier of bonuses meant to reward you and increase your investment potential over time. Even better? The earlier you invest, the bigger your bonus eligibility becomes.

Frequently Asked Questions

Why invest in startups?

Regulation CF allows investors to invest in startups and early-growth companies. This is different from helping a company raise money on Kickstarter; with Regulation CF Offerings, you aren’t buying products or merchandise - you are buying a piece of a company and helping it grow.

How much can I invest?

Accredited investors can invest as much as they want. But if you are NOT an accredited investor, your investment limit depends on either your annual income or net worth, whichever is greater. If the number is less than $124,000, you can only invest 5% of it. If both are greater than $124,000 then your investment limit is 10%.

How do I calculate my net worth?

To calculate your net worth, just add up all of your assets and subtract all of your liabilities (excluding the value of the person’s primary residence). The resulting sum is your net worth.

What are the tax implications of an equity crowdfunding investment?

We cannot give tax advice, and we encourage you to talk with your accountant or tax advisor before making an investment.

Who can invest in a Regulation CF Offering?

Individuals over 18 years of age can invest.

What do I need to know about early-stage investing? Are these investments risky?

There will always be some risk involved when investing in a startup or small business. And the earlier you get in the more risk that is usually present. If a young company goes out of business, your ownership interest could lose all value. You may have limited voting power to direct the company due to dilution over time. You may also have to wait about five to seven years (if ever) for an exit via acquisition, IPO, etc. Because early-stage companies are still in the process of perfecting their products, services, and business model, nothing is guaranteed. That’s why startups should only be part of a more balanced, overall investment portfolio.

When will I get my investment back?

The Common Stock (the "Shares") of Bunch AI Agents, Inc (the "Company") are not publicly-traded. As a result, the shares cannot be easily traded or sold. As an investor in a private company, you typically look to receive a return on your investment under the following scenarios: The Company gets acquired by another company. The Company goes public (makes an initial public offering). In those instances, you receive your pro-rata share of the distributions that occur, in the case of acquisition, or you can sell your shares on an exchange. These are both considered long-term exits, taking approximately 5-10 years (and often longer) to see the possibility for an exit. It can sometimes take years to build companies. Sometimes there will not be any return, as a result of business failure.

Can I sell my shares?

Shares sold via Regulation Crowdfunding offerings have a one-year lockup period before those shares can be sold under certain conditions.

Exceptions to limitations on selling shares during the one-year lockup period:

In the event of death, divorce, or similar circumstance, shares can be transferred to:

• The company that issued the securities;

• An accredited investor;

• A family member (child, stepchild, grandchild, parent, stepparent, grandparent, spouse or equivalent, sibling, mother-in-law, father-in-law, son-in-law, daughter-in-law, brother-in-law, or sister-in-law, including adoptive relationships).

What happens if a company does not reach their funding target?

If a company does not reach their minimum funding target, all funds will be returned to the investors after the close of the offering.

How can I learn more about a company's offering?

All available disclosure information can be found on the offering pages for our Regulation Crowdfunding offering.

What if I change my mind about investing?

You can cancel your investment at any time, for any reason, until 48 hours prior to a closing occurring. If you’ve already funded your investment and your funds are in escrow, your funds will be promptly refunded to you upon cancellation. To submit a request to cancel your investment please email: info@dealmakersecurities.com

How do I keep up with how the company is doing?

At a minimum, the company will be filing with the SEC and posting on its website an annual report, along with certified financial statements. Those should be available 120 days after the fiscal year end. If the company meets a reporting exception, or eventually has to file more reported information to the SEC, the reporting described above may end. If these reports end, you may not continually have current financial information about the company.

What relationship does the company have with DealMaker Securities?

Once an offering ends, the company may continue its relationship with DealMaker Securities for additional offerings in the future. DealMaker Securities’ affiliates may also provide ongoing services to the company. There is no guarantee any services will continue after the offering ends.